Additional Tools

Currently, there are many FIU(s) worldwide using Anti-Money Laundering solutions in various capacities. These versatile systems provide flexibility and a high degree of flexibility. Their outputs can be largely enhanced by extending their functionality in certain areas. We have designed a set of additional tools (Add-ons) to enrich the ecosystem of these solutions and extend their functionality without altering their code-base. FIUs are responsible for gathering financial disclosures from accountable institutions under the AML/CFT Act, enriching the collected data by obtaining intelligence from non-financial sources, analyzing the information, and creating an intelligence package to guide investigations into potential offenses that generate illicit proceeds of crime. To automate the above processes, we have created an end-to-end solution that integrates all the modules and features needed by any FIU irrespective of its type. A solution that meets your needs today and grows with you into the future. We offer you FIU360.

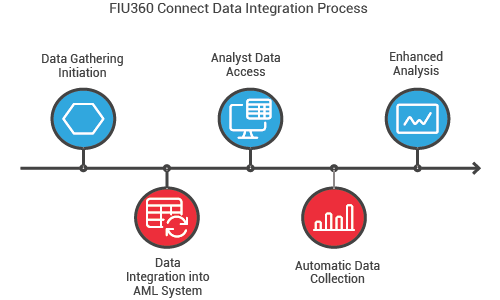

FIU 360 connect

FIU360 Connect is an advanced add-on suite designed to enhance data reporting by seamlessly gathering information from financial sources, government databases, and open-source platforms. This enriched data integrates directly into the Anti-Money Laundering (AML) system, enabling analysts to view and analyze both the original reported data and supplementary data from enrichment tools within a unified platform. FIU360 Connect can automatically collect additional data upon receipt of a report by the FIU or whenever an analyst requires more context from connected sources, streamlining data acquisition and enhancing analysis.

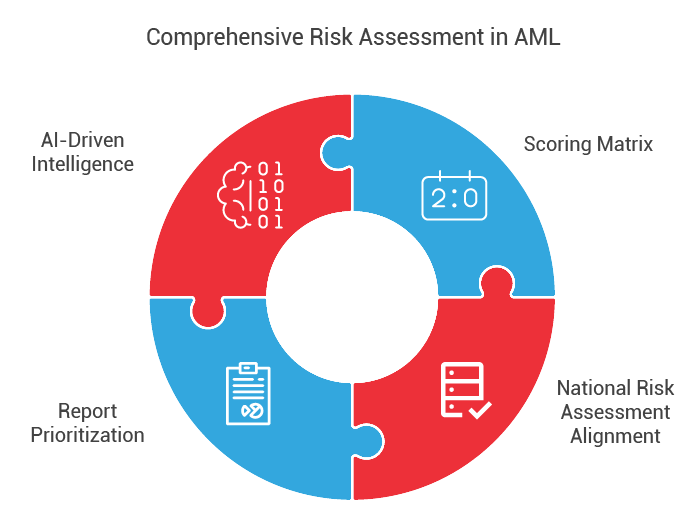

rba scoring

While standard AML systems utilize basic fact scoring matrices that rate individuals, accounts, and entities on a limited set of five variables, our advanced risk-based approach (RBA) scoring matrix considers over 150 variables and their combinations. Tailored to align with each country’s National Risk Assessment (NRA) findings, this scoring model allows for in-depth risk assessment across a wide array of entities and report types, such as Suspicious Transaction Reports (STR), Threshold Transaction Reports (TFR), and individual accounts. The RBA scoring not only enhances report prioritization by categorizing them as high, medium, or low risk but also strengthens the intelligence capabilities of the analysis department through AI-driven scores for each entity in the database.

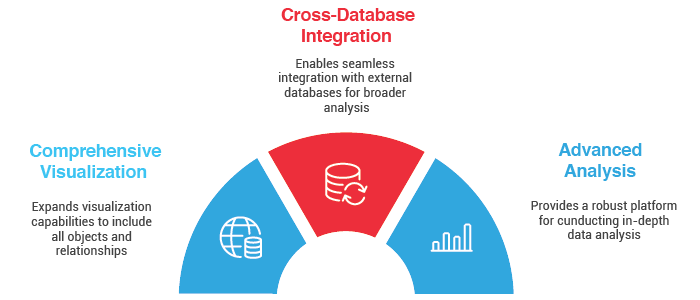

Traditional AML systems come equipped with basic visualization tools, often limited to displaying certain objects stored within their databases. Our enhanced visualization solution expands on this capability, offering comprehensive visualization of all objects and relationships stored in the system’s database. It also supports seamless integration with external databases, allowing for cross-database visualization, thereby providing a more robust, interconnected view of data for advanced analysis.